Recession of 1937-38

America’s third-worst downturn of the 20th century

Banking Act of 1935

This legislation restructured the Fed in both cosmetic and consequential ways

Gold Reserve Act

The 1934 law was the culmination of FDR’s controversial gold program

Banking Act of 1933

Commonly called Glass-Steagall, the Act was widely debated before its enactment

Roosevelt’s Gold Program

The controversial and consequential policies of FDR regarding gold and dollars

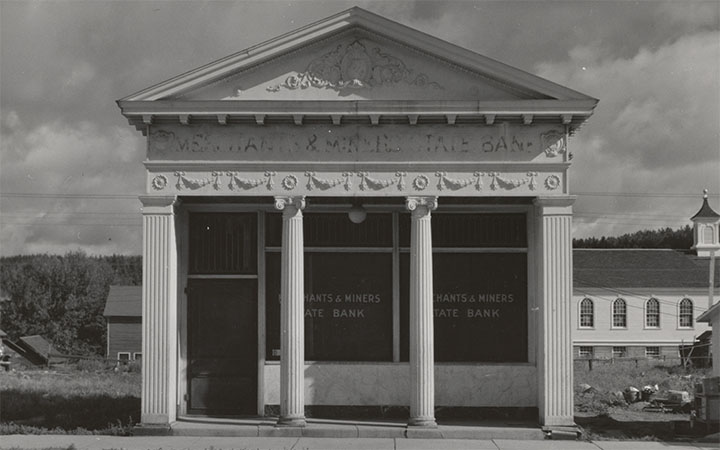

Emergency Banking Act

The 1933 law was aimed at restoring public confidence in the nation’s financial system

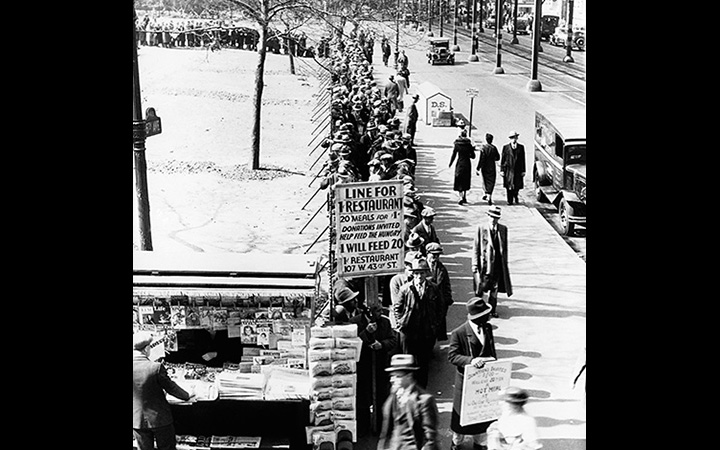

Bank Holiday of 1933

For an entire week in March 1933, all banking transactions were suspended

Emergency Lending to Nonbank Borrowers

The Emergency Relief and Construction Act of 1932 expanded the Fed's ability to make certain loans under "unusual and exigent circumstances."

Banking Act of 1932

The Banking Act of 1932 reformed the Federal Reserve’s role providing credit during economic downturns.

Reconstruction Finance Corporation Act

During the years 1932 and 1933, the Reconstruction Finance Corporation effectively served as the discount lending arm of the Federal Reserve Board.

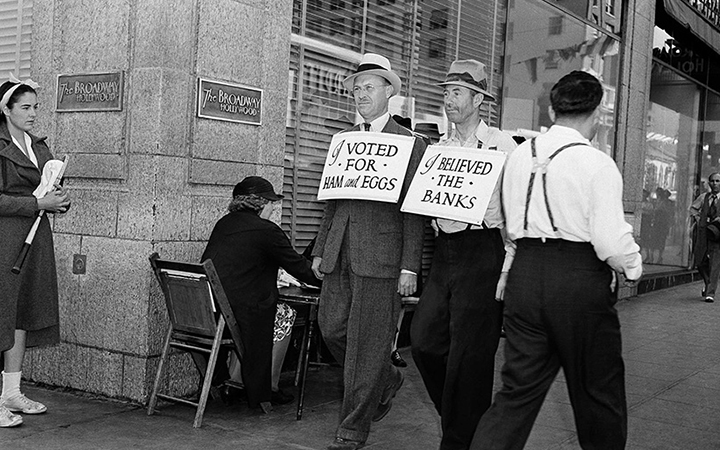

Banking Panics of 1931-33

Earlier regional banking panics turned into a nationwide financial crisis in fall 1931

Banking Panics of 1930-31

The U.S. appeared to be poised for economic recovery when a series of bank panics began in fall 1930

Crash of 1929

On October 28, 1929, the Dow declined nearly 13 percent