Various pieces of legislation have shaped the Fed’s structure and policy mandates.

Dodd-Frank Act

This wide-ranging legislation was signed by President Obama in 2010

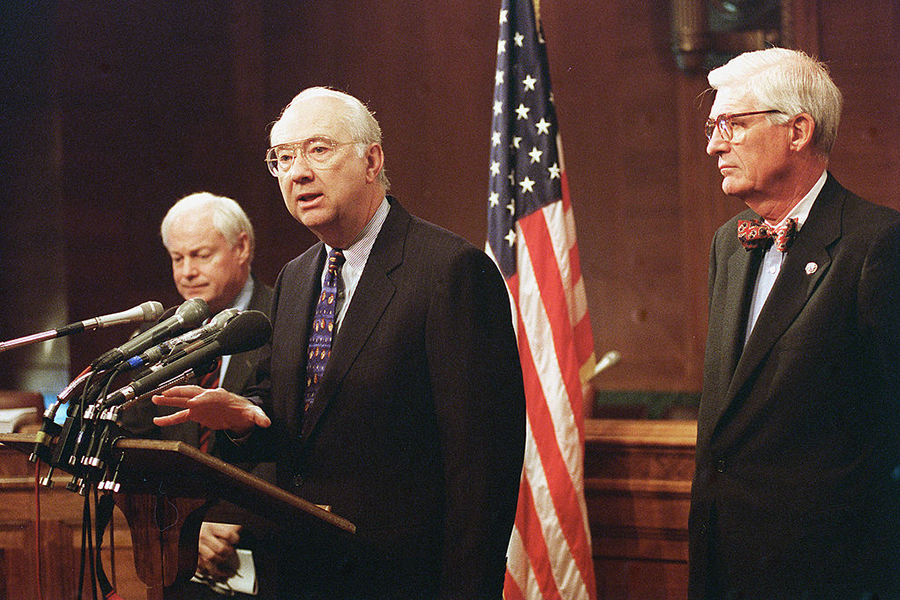

Gramm-Leach-Bliley Act

The 1999 Act promoted financial integration by repealing parts of the Glass-Steagall Act while giving the Fed new supervisory powers

Home Ownership and Equity Protection Act of 1994

HOEPA addresses unfair, deceptive, or abusive mortgage lending practices

Riegle-Neal Act

The 1994 law removed many of the restrictions on bank branching across state lines

FDICIA

The 1991 Act was intended to address problems in the banking and thrift industries

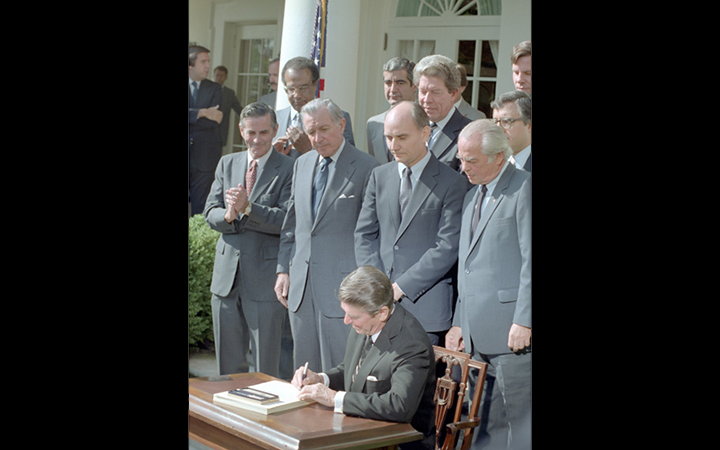

Garn-St Germain Act

The 1982 Act aimed to ease pressures on depository institutions as the Fed acted to curb inflation

Monetary Control Act

The 1980 Act was one of the most important laws to affect the Fed in its 100-year history

Full Employment and Balanced Growth Act

Commonly called Humphrey-Hawkins, the 1978 Act set new goals for the nation’s economic policymakers

Federal Reserve Reform Act

This 1977 law was instrumental in shaping the current Fed

Community Reinvestment Act

The Federal Reserve and other federal banking agencies have implemented the CRA since its passage in 1977

Bank Holding Company Act

In 1956, Congress gave the Fed increased oversight of the banking industry

Employment Act

President Truman signed the Act in 1946 in the aftermath of WWII

Banking Act of 1935

This legislation restructured the Fed in both cosmetic and consequential ways

Gold Reserve Act

The 1934 law was the culmination of FDR’s controversial gold program

Banking Act of 1933

Commonly called Glass-Steagall, the Act was widely debated before its enactment

Emergency Banking Act

The 1933 law was aimed at restoring public confidence in the nation’s financial system

Banking Act of 1932

The Banking Act of 1932 reformed the Federal Reserve’s role providing credit during economic downturns.

Reconstruction Finance Corporation Act

During the years 1932 and 1933, the Reconstruction Finance Corporation effectively served as the discount lending arm of the Federal Reserve Board.

McFadden Act

The Fed’s success led to this legislation in 1927, which rechartered the Federal Reserve Banks in perpetuity among other items

Federal Reserve Act Signed

The Federal Reserve Act became law in December 1913, culminating three years of debate